Net Present Value NPV: Definition, Examples & Calculation

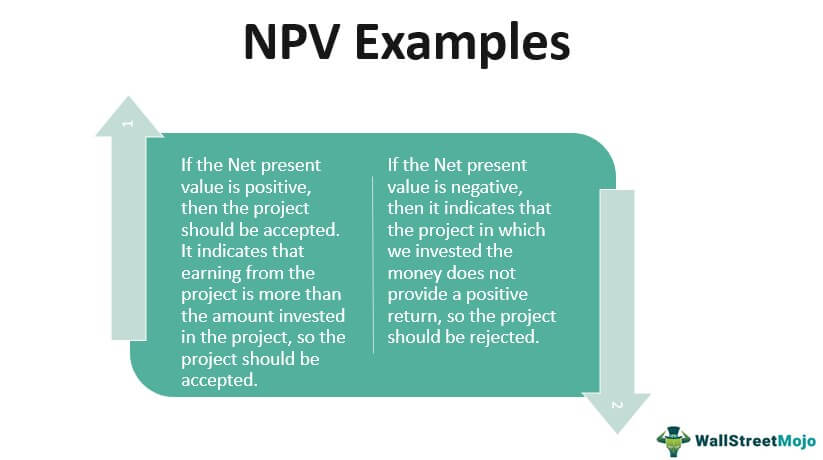

Net present value (NPV) compares the value of future cash flows to the initial cost of investment. This allows businesses and investors to determine whether a project or investment will be profitable. A positive NPV suggests that an investment will be profitable my fuel tax while a negative NPV suggests it will incur a loss. When the interest rate increases, the discount rate used in the NPV calculation also increases. This higher discount rate reduces the present value of future cash inflows, leading to a lower NPV.

- Evaluate the role of cost of capital in decision-making and explore the trade-offs between risk and return.

- NPV is widely used in capital budgeting and to know the profitability of the project.

- Using the discount rate, calculate the present value of each cash flow by dividing the cash flow by (1 + discount rate) raised to the power of the period in which the cash flow occurs.

- Investing in real estate involves purchasing physical properties (residential, commercial, or industrial) or investing through Real Estate Investment Trusts (REITs).

- The discount rate is OFTEN based on a company’s weighted-average cost of capital (WACC… click HERE for the definition).

Tools to Help Calculate NPV

Put another way, it is the compound annual return an investor expects to earn (or actually earned) over the life of an investment. An individual is considering whether to invest in a mutual fund or directly purchase individual stocks. This investment decision requires evaluating factors such as diversification, management fees, and the investor’s own expertise in selecting stocks. If the individual prefers a hands-off approach and diversification, they may choose a mutual fund, while a more experienced investor seeking higher potential returns may opt for direct stock investments.

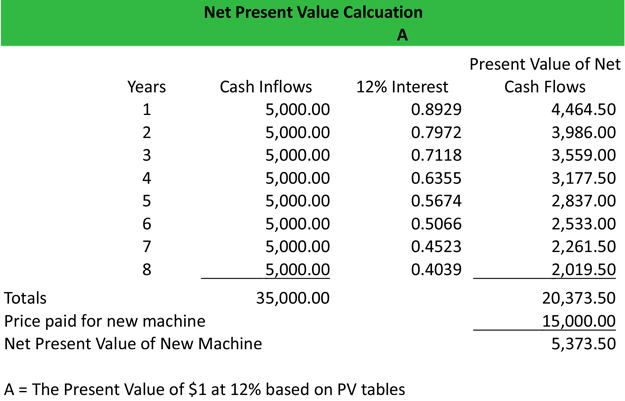

Example Net Present Value Calculation

NPV provides a dollar amount that indicates the projected profitability of an investment, considering the time value of money. Conversely, ROI expresses an investment’s efficiency as a percentage, showing the return relative to the investment cost. NPV is often preferred for capital budgeting because it gives a direct measure of added value, while ROI is useful for comparing the efficiency of multiple investments. Moreover, the payback period calculation does not concern itself with what happens once the investment costs are nominally recouped.

Positive NPV vs. Negative NPV

To value a project is typically more straightforward than an entire business. A similar approach is taken, where all the details of the project are modeled into Excel, however, the forecast period will be for the life of the project, and there will be no terminal value. Once the free cash flow is calculated, it can be discounted back to the present at either the firm’s WACC or the appropriate hurdle rate. The second point (to account for the time value of money) is required because, due to inflation, interest rates, and opportunity costs, money is more valuable the sooner it’s received.

NPV is widely used in capital budgeting and to know the profitability of the project. A notable limitation of NPV analysis is that it makes assumptions about future events that may not prove correct. The discount rate value used is a judgment call, while the cost of an investment and its projected returns are necessarily estimates. However, what if an investor could choose to receive $100 today or $105 in one year?

Using the discount rate, calculate the present value of each cash flow by dividing the cash flow by (1 + discount rate) raised to the power of the period in which the cash flow occurs. This calculation will provide the present value of each cash flow, adjusted for the time value of money. This concept is the foundation of NPV calculations, as it emphasizes the importance of considering the timing and magnitude of cash flows when evaluating investment opportunities. The net present value is the difference between the present value of future cash inflow and the present value of cash outflow over a period of time.

Companies use this calculation to estimate values for future revenues or liabilities. When you calculate present value, you’re trying to measure the value of future cash flows today. Businesses and governments can use capital budgeting methods to determine how much of a return they’re likely to see on a project before funding it. The NPV formula takes into account the time value of money, a concept which suggests that a sum of money received now is worth more than that same sum received at a future date. Net present value or NPV represents the difference between the present value of cash inflows and outflows over a set period of time. Knowing how to calculate NPV can be useful when trying to determine whether an investment — either business or personal — will eventually pay off.

Management views the equipment and securities as comparable investment risks. NPV is the result of calculations that find the current value of a future stream of payments using the proper discount rate. In general, projects with a positive NPV are worth undertaking, while those with a negative NPV are not.

My Accounting Course is a world-class educational resource developed by experts to simplify accounting, finance, & investment analysis topics, so students and professionals can learn and propel their careers. Because the equipment is paid for upfront, this is the first cash flow included in the calculation. No elapsed time needs to be accounted for, so the immediate expenditure of $1 million doesn’t need to be discounted. To account for the risk, the discount rate is higher for riskier investments and lower for a safer one.