A disadvantage of using the dual rate method is that idle capacity costs for theservice departments are allocated to the user departments. This problem is eliminated by using the single budgeted rate method illustrated below. There are no service departments left, so the legal department can only allocate costs to operating departments. For example, hospitals use sophisticated methods for allocating costs of service departments such as Housekeeping, Patient Admissions, and Medical Records to patient wards and outpatient services, and then to individual patients. Historically, these allocations were important to hospitals because Medicare reimbursement was based on actual costs.

Direct Method of Cost Allocation: Example, Calculation

The Assembly Department manager is likely to complain that neither of the allocations in Exhibit 6-11 is equitable. He or she might logically argue that the dual rate method illustratedabove assigns the Power Department’s idle capacity costs to the Assembly Department. These idle capacity costs will in turn be allocated to the AssemblyDepartment’s products. Using a single budgeted rate, rather than either a single actual rate or dual rate (Exhibit 6-11) will normalize the service costsallocations, provide more timely costing and aid in evaluating the service departments.

5: Allocation of Service Department Costs

- Discuss how a plant wide overhead rate tends to distort product costs.

- Although the specific amounts of the reciprocal transfers are not needed tocomplete the allocations to the producing departments, they are needed so that entries can be made to record the transfers between the service departments.

- Allocate the service department costs to both service departments and producing departments based on the allocation proportions provided in Table 1.

- Describe three general methods of assigning costs to products including one stage and two stage approaches.4.

- In addition to the allocations to Cutting and Assembly, the Power Department allocates $11,535 toMaintenance and $5,768 to itself, while the Maintenance Department allocates $3,817 to the Power Department and $5,726 to itself.

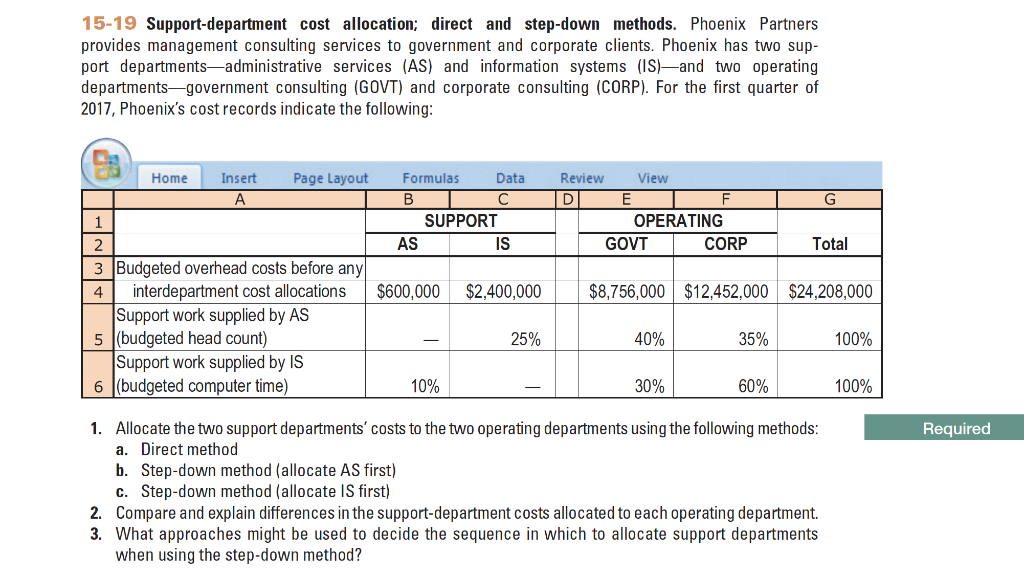

Although it requires a certain level of mathematical sophistication, this level of detail and precision can yield more accurate cost assignments and can facilitate better decision-making. Direct allocation, sometimes referred to as the direct method, is the most straightforward approach to cost allocation. Simply put, this method entails assigning costs directly to the appropriate cost objects, such as departments, products, or services, without taking into account whether those costs were incurred by multiple cost objects. In some cases, companies benefit from allocating fixed costs using a different allocation base than variable costs. How is the sequence of the service departmental cost allocations determined in the step-down method?

Ask a Financial Professional Any Question

In the retail industry, purchasing and storing inventory comprise a significant portion of costs. Transportation costs, warehouse expenses and inventory buying costs are examples of costs that are allocated across various products. While using sales volume might seem the easiest route, it might distort cost allocation for slow-moving or seasonal products. For instance, a law firm may find it challenging to allocate the cost for a lawyer who handles various cases simultaneously. Similarly, a hospital might struggle with cost allocation for shared resources, such as an MRI machine used by multiple departments. These challenges necessitate creative and fair methods to spread costs and ensure profitability.

Direct Method

The various functional areas within a manufacturing facility are usually separated into two types of departments. These include producing departments and service departments.Producing departments convert raw, or direct materials into finished products. Service departments provide support services to the other departments in theplant. Some examples of service departments include purchasing, receiving and storage, engineering, power, maintenance, packing, shipping, inventory control,inspection and quality control. Service department costs must be assigned (applied, allocated, or traced) to the inventory for product costing purposes.

Note 2 It doesn’t really matter which of the two remaining cost centres you start with. Note 3 On the last reapportionment, D’s overheads are apportioned on the basis of 75/95 to A and 20/95 to B. The reciprocal service to C is ignored as, by now, it is not material. However, if we choose to fully reflect the reciprocal services between C and D, one of two methods are possible – the repeated distribution approach or the algebraic approach.

Inappropriately allocating costs could lead some stakeholders to wrongly believe that an organization is not committed to its CSR responsibilities. Therefore, cost allocation not only influences the actual implementation of CSR measures but also political and the entry to adjust the accounts for salaries public perceptions of an organization’s ethical and social responsibilities. For example, an IT company might allocate shared costs like server expenses, software license fees, and maintenance costs based on the users or usage in different departments.

Instead, we will allocate ALL of the services of each of these departments to the operating departments. By considering the flow of services between cost centers, the step-down method provides a more accurate representation of the actual resource consumption within the organization. However, this straightforward approach can face complications when dealing with shared or indirect costs. For example, in a factory that builds both toasters and microwaves, how would one allocate the cost of shared raw materials, like steel or energy used in the factory?

Activity based rates would be needed to provide accurate product costs since direct labor is not used in proportion to machine hours.d. The purposes of cost allocations are closely related to the purposes of information systems outlined in Chapter 2 (See Exhibit 2-4 for a review). Cost allocations are needed to value inventory for external reporting purposes, for planning and monitoring thecost of activities and processes, and for various short term and long term strategic decisions. In addition,since cost allocation methods are components of the overall performance evaluation system, cost allocations tend to influence the behavior of theparticipants within the system. Therefore, system designers must also carefully consider the motivational, or behavioral aspects of alternative cost allocationmethods. To show how a single plant wide overhead rate can distort product costs, assume that the firm in Example 6-1 produces two products, X1 and X2.

The dual rate or flexible budget method refers to using separate rates, or allocations for fixed and variable service costs. The purpose of this method is to prevent the actualcost allocations to users from being influenced by the quantity of service consumed by other users. Allocating fixed and variable service costs using asingle actual rate can result in a variety of cost distortions. For example, situations arise where a user’s budgeted and actual consumption of a serviceare the same, but the actual service cost allocation to the user is greater than the budgeted allocation.